In today’s fast-paced world, securing your family’s future while planning for life’s milestones demands a financial solution that balances guaranteed income, flexibility, and comprehensive protection. Enter the Axis Max Life Smart Vibe Plan—a revolutionary insurance product designed to empower you with instant liquidity, lifelong security, and a lump-sum maturity corpus.

Whether you’re saving for your child’s education, planning retirement, or safeguarding your loved ones, this blog dives deep into why the Smart Vibe Plan is a game-changer.

Table of Contents

Why Choose the Axis Max Life Smart Vibe Plan?

The Smart Vibe Plan stands out with its triple advantage: Instant Income, Enhanced Protection, and Significant Maturity Returns. Here’s a snapshot of its unique features:

- 50% Instant Income: Receive 50% of your annual premium back immediately in the first year and throughout the Premium Payment Term (PPT).

- 2X Death Benefit: Ensure your family’s financial safety with double the coverage post-PPT.

- Tax-Free Maturity Payout: Enjoy a lump-sum amount at policy maturity to fund retirement, travel, or other goals.

- Senior Citizen Benefits & Policy Continuance: Exclusive perks for older adults and options to keep the policy active during financial hardships.

Key Features & Benefits of Smart Vibe

1. Insta Wealth & Insta Wealth Boost Variants

- Insta Wealth:

- Regular income during the PPT with flexible payout options (0%, 25%, 50%, or level income).

- Choose from policy terms of 10–30 years.

- Insta Wealth Boost (New):

- Higher premium bands and 2X death coverage post-PPT.

- Enhanced maturity boosters and future milestone benefits.

2. Guaranteed Returns with Flexibility

- Earn Rs. 2.5 lakh/year instantly (for a 5L annual premium) during the PPT.

- Customize payouts to align with financial goals like education fees or retirement.

3. LifeStage Protection

- Cover Continuance Benefit: Keep the policy active even if you miss premiums.

- Express Claim Relief: Faster claim settlements for emergencies.

- Optional riders like Waiver of Premium (WOP+), Accidental Death Benefit (ADD), and Critical Illness (CIDR).

4. Senior Citizen Advantages

- Tailored benefits for policyholders above 60, including extended coverage and income stability.

How Does the Smart Vibe Plan Work? A Real-Life Example

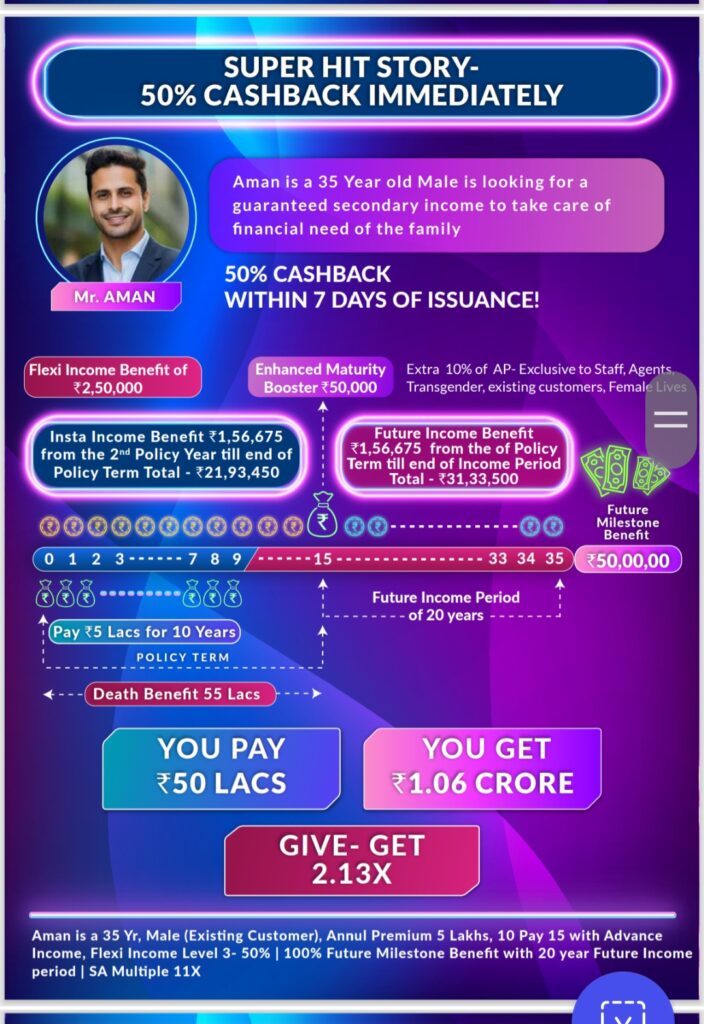

Let’s break down a scenario for a 35-year-old male opting for the Insta Wealth Boost variant:

- Policy Details:

- Premium Payment Term (PPT): 10 years

- Annual Premium: Rs. 5 lakh (paid in advance)

- Policy Term: 35 years

- Benefits:

- Instant Income: Rs. 2.5 lakh/year (50% of premium) during the PPT.

- Death Benefit: 2X coverage post-PPT, ensuring family security.

- Maturity Corpus: Rs. 2.99 crore at the end of 35 years.

Result: The customer enjoys a steady income stream, robust protection, and a tax-free corpus to relish retirement.

Smart Vibe vs. Traditional Plans: Why It’s Better

Most insurance policies delay returns for years. Here’s how Smart Vibe outperforms them:

| Feature | Smart Vibe Plan | Traditional Plans |

|---|---|---|

| Income Start Time | Immediate (Year 1) | After 3–5 years |

| Death Coverage | 2X post-PPT | Fixed sum assured |

| Flexibility | Customizable payouts & riders | Limited options |

| Senior Citizen Benefits | Yes | Rarely offered |

FAQs About Axis Max Life Smart Vibe Plan

Q1. What is the minimum entry age?

- 3 years (for minors, policy vests at 18). Adults can opt in at 18+.

Q2. Can I discontinue premiums?

- Yes! The Premium Offset and Policy Continuance benefits allow flexibility during financial crunches.

Q3. Are returns taxable?

- No! Maturity proceeds are tax-free under Section 10(10D) of the IT Act.

Q4. How long does coverage last?

- Policy terms range from 10–35 years, depending on the variant.

Conclusion: Secure Your Future with Smart Vibe

The Axis Max Life Smart Vibe Plan isn’t just an insurance policy—it’s a financial safety net that grows with you. With unmatched features like instant income, customizable protection, and senior-focused benefits, it’s designed to adapt to your evolving needs.

Ready to take control of your financial journey? Connect with an Axis Max Life advisor today or visit their website to explore the Smart Vibe Plan in detail.

Leave a Comment